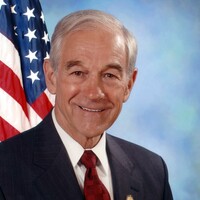

A Circle for discussion on the impact, philosophy, and work of Dr. Ron Paul

In this Ron Paul Liberty Report, Paul (3:23) calls Bretton Woods a "pseudo gold standard." He says it "...a pseudo gold standard: it was a gold reserve standard." So, to Paul, a gold *reserve* standard is a pseudo gold standard. I don't know if this is what he means, but there is a difference between dollars backed by gold and gold that actually circulates. The main gold that circulated, or that circulated *outside* of business ledgers and outside of the banking system was these ten and twenty-dollar coins, is that not right? But Roosevelt had ended that system in 1933. Americans themselves weren't formally allowed to hold gold, Paul points out. Whether the government ever finally put that in to place, I don't know, but gold was pretty much de-monatized domestically while the government from that point started building up it's large hoards of gold in the Treasury repositories out of touch from, safely away from supply to the public.

Next thing that I note that he says is: "The Federal Reserve can ...manipulate. And they do this without direct Congressional approval. ...People say, "Well it's a darned good thing that the Fed could bail them out." But it's not a darned good thing that the Fed created the monster. And that is where the problem is, because on the short run, their seems to be benefits, and even on the longer run when the market demands a correction and a liquidation of debt, the Fed can still paper it over and people are so anxious to have some help, they do it." Then, he goes back to the main topic--BRICS, even France did a yuan-based something-or-other.

His co-commentator says, "Debt maybe will be a bad word, once again." Which brings to my mind the question: Earlier Paul was discussing the Fed bailing out the non-governmental sector. In that case, it's not government debt put private sector debt that is being discussed, yes?

Next, Paul points out that our politicians, even the good ones get sidetracked into, like to blame our problems on China. "They take our money, but then they go and invest it overseas. They [our politicians] say 'They're all over Africa now! And they're getting ahold of all the metals and control.' But they're doing that by--we buy their stuff! It isn't like--. They send more dollars overseas; I guess that's a circuitous way of us having foreign aid."

19:54 Talks about a "mistaken" (he says) position he took in the 1970's involving currency reform. I suppose he means he had exaggerated, in his mind, the devaluation what would take place. At that time gold went from 35 an ounce to eight hundred over a very short period, so that perhaps affected his thinking. But he says while the dollar has been devaluating, there never was a recall like some countries did in which all dollars were called in and re-issued with more zeros on them! Watch this part yourself to get accurately what he briefly mentioned.

21:04 Then he talks about "the attack on cash." "The government and banks are trying to get us to stop using even checking accounts (hence the CBDC push) and cash especially." The government he says is aiming at invading our privacy. Lots of you have been saying this, yes?

I myself would point out that from a public policy perspective, cash is money that is outside of the banking system, but which still is there in circulation. The money in the banking system is more instable than cash because it is all wrapped up with credit, but cash is there still when all the credit mountain crashes, a source of stable liquidity. It would be nonsense except there's actually quite a bit of cash out there, and cash could be made more useful by increasing the sizes of the denominations of bills and coin such that cash could hold a larger share of MQ. In the past, until fairly recently, there were larger denominations, but now we have as the largest, just the hundred dollar bill. Now, before 1933, correct me if I am wrong, but gold coin circulated alongside the silver dollars, and there wasn't this mountain of gold driving up the price of gold such as to drive coin made of it out of circulation; a mountain of gold bullion which just sits there even today, just sitting in the Treasury vaults at West Point, and in Colorado and Kentucky.

23:13 He talks about people he knows who tell him, I have to go buy the court house and pay my water bill. i.e., "pay my water bill" *in cash*. Actually, this is really common, I think. Unless one has direct deposit for paying ones bills (and then one loses management of one's money and risks bouncing payments), one basically has to pay ones bills in one way or another. It's got to be really annoying to mail a check every month. Logging on to a computer to pay is almost harder than that. With us, some of the bills are auto-deducted. I think the mobile phone company got us to get it all combined, the electric, the phone, the mobile phone and the internet into one single payment through them, by offering us a low price discount! So I never had an idea how much it costed to call my mother in America. Our rent, seems obvious, is deducted automatically. But most of our utility bills, I pay in cash at the convenience store! At the very least, one would still have to physically go to the convenience store and present the paper bill and ones bank card, or have some complicated system set up on ones computer (nowadays everyone does this kind of stuff all on their smartphone--poor Mike Lindell!) to make payments or have it all auto-deducted and risk bouncing it all.

Putting my armchair theorist hat back on. Again, the public policy advantage of cash is that the banks aren't able to inflate it into an enormous amount of credit creation. Not that credit is bad--Richard Werner has some positive discussion about credit creation, with a recommendation that we need lots and lots of very small banks like German has. Werner is a German, so of course he says that, but... He also claims it's not the Germans that are behind all the bad stuff in Europe, but the EU... a bit of an eye opener if one believes he isn't just biased. Credit creation inflates, mostly asset inflation, not so much the cause of price inflation, it seems to me, but then it deflates again, usually in sudden catastrophic crashes. Of course, there's also semi-deflationary stagnation but we can't cover all in one post, please. And actually, there's quite a lot of cash out there. I think there could be more if we'd start-up large denomination notes and coins again.

Finally, cheery Paul concludes with "And, I'd like to invite you again. Please come back soon." But now, Ron Paul is Cheery, but Rand Paul, Ron Paul's son, now Rand Paul is a real Matt Gaetz, a real firebrand, isn't he. Does tremendous work, including on the finance comittee, though I, with my MMT perspective, wouldn't put him on the chair--maybe on the vice chair seat to keep an eye on things. To make it bipartisan, I'd throw in that guy, what's his name who always votes with the Republicans.

https://rumble.com/v2fmzk8-when-will-the-dollar-be-dethroned-whose-fault-is-it.html?start=139

https://financialservices.house.gov/news/documentsingle.aspx?DocumentID=237384

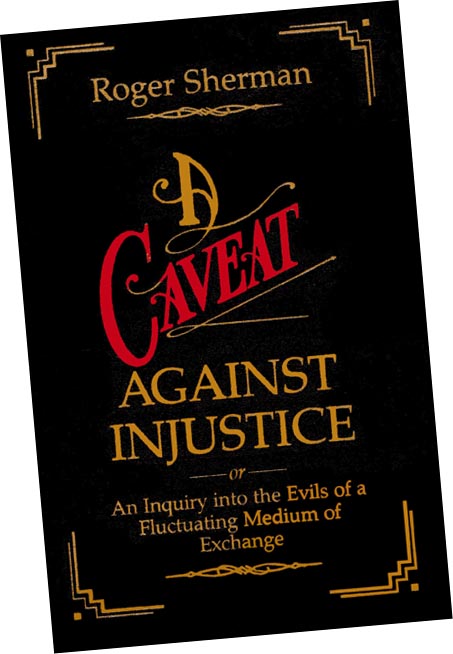

In this link from 2011, Paul shows his interest in coin as Bureau of Weights and Measures topic, if, as appropriate to a topic at core involving money, in one view of it, an activity conducted by the Mint, the Treasury.

The government certifying a specific quantity (nine tenths of an ounce of silver, in the original dollar coin of 1792, or of gold, in the twenty dollar coin) when money is thought to be and is thought to ought to be bullion adds but little service to either the public or to itself in its basic, fiscal, functions. It is interesting to note, though, that there was a period in the nineteenth century in which the Treasury provided for the free minting of private silver into dollar coins. Not entirely free--similar to our primary dealer system with Treasuries, I think this service was limited to the mining companies. But what that provided--given the somewhat unlimited supply of silver due to its production as byproduct of the mining of other metals--is a solid money supply, at least in terms of daily currency. A book I am reading points out one has to differentiate the MQ of coins and paper dollars from the total MQ, the bulk of which historically was always first and foremost ledger money. But if talking coins, one must still point out that with a growing economy, a growing supply of daily use wallet currency is nevertheless still required; if the coins themselves rise in value, as they will, even against the material they are made of, whether gold or silver, due to lack of minting, the coins will fail to circulate as they will serve instead as collateral in bank vaults the way bullion has always done; and also one must point out that even now, coin and paper dollars are a significant portion of our money.

In this situation, in the link: The Treasury is minting bullion coins, and then selling them roughly at par to the public. It is an unnatural activity that would serve very little purpose were said coins actually intended as real currency--barring if the supply were in no wise withheld, money supply as described above. In that real currency scenario, the government would, ideally, directly spend these coins fiscally into circulation or, as now with our quarters, nickels, dimes and pennies, sell them to the banks for use in the Moneymatic Machine supply cycle, not to collectors item dealerships. The coins would have a concrete use and purpose and actually enter circulation by such sort of means.

The price of a silver dollar would, by actual use, together with the growing money supply demand of a growing world silver dollar economy, rise above that of the silver they are minted with except as held in check by sufficient mintage thereof. Due to the artificial demand provided by taxes to the value of money, a government minted silver dollar should also by that means naturally rise bit by bit continually above the market value of the silver it contains, if no countermeasures were deployed to prevent it; as the same principle equally applies to the ratio of the value of a greenback to its, albeit tremendously lower price of paper raw material, it seems clear that something has gone quite wrong such that the value of an ounce of silver is now twenty dollars rather than the value of a dollar, once equal to .9 ounces of silver, is not instead now worth twenty ounces in silver. As this principle of taxation inserting the "tiny silver plug core" of value into the otherwise too physically large penny should apply to a large or small quantity of money supply in a non one-to-one ratio--since we are applying value, not quantity into the core of the coin, together with the other points of growth of the economy et cetera, it is not "money printing" per se that has devalued the dollar twenty times from its 1792 value (granting the false premise for purpose of discussion that bullion represents accurately the value of goods and services). Perhaps taxes are too low to properly drive demand for the currency. I add that fiscal spending, as, like that of any business or organization, is intended to a purpose and purpose equates to supply--that low fiscal spending equates to high prices. A failure to tax profits and reapportion them into useful production is also a source, again, of high prices due to a failure of adequate material supply that comes from gradual monopolization, and thereby, gradual withdrawal from use, of resources by the private sector entities that acquire them.

George Selgin, March 15, 2021

Ron Paul and Our Big, Fat Fed

https://www.cato.org/blog/ron-paul-our-big-fat-fed

Selgin writes:

By the time the Great Recession ended, the Fed’s balance sheet was more than four times as large as it was in mid‐2008. And now...it has doubled in size yet again, to just shy of $7.6 trillion.

And Ron Paul is partly responsible for it.

Every dollar the Treasury puts into the TGA reduces the banks’ combined reserve balances by one dollar. It follows that, whatever level of reserve balances the Fed considers necessary to keep its “abundant reserve” or floor system functioning smoothly and otherwise achieve its macroeconomic objectives, preserving that level requires a Fed balance sheet that’s X dollars bigger for every X dollars in the TGA account. So, when the Treasury stuffed $1.8 trillion into that account, the Fed had to compensate by arranging to add $1.8 trillion more to its portfolio than it might have added otherwise.

[Talking about old Eccles, long ago:]

Eccles went on to explain that the direct‐purchase authority was “in effect, merely an overdraft privilege with the Reserve banks—a line of available credit for use if needed,” without which “the Treasury would feel obliged to carry much larger cash balances.”

As The New York Times explained on March 31, 1979, a temporary debt ceiling of $798 billion was scheduled to revert, after midnight, to what had been its “permanent” level of just $400 billion. As part of its effort to avoid breaching the ceiling before Congress could raise the ceiling again, the Treasury took advantage of the Fed’s direct purchase authority to borrow $3 billion from the Fed. To do so, it

"first redeemed $3 billion of securities from the Exchange Stabilization Fund, which is utilized to buy foreign currencies to bolster the dollar. This lowered the national debt by that amount, enabling the Treasury to arrange a loan from the Federal Reserve. Such loans are included under the $798 billion ceiling."

One of the hawks who severely disapproved of this maneuver was Ron Paul...

[The "overdraft" expired for good two years later.]

Not Paul’s Fault

What Paul couldn’t have anticipated was the Fed’s October 2008 decision to begin paying interest on bank reserves. That decision once again made it profitable for the Treasury to favor TGA balances over TT&L balances.

[

My (Mac's) comments:

Selgin gives this, rather mercenary, reason for the Treasury stopping storing its money in private banks and banking once again primarily with the Fed. I had presumed the real reason was as a sort of balance to the Fed's excess reserves post 2008 system, or just as a result of that system that it didn't matter much and so they just did it that way, but either way, the result is as Selgin discusses it. But the withdrawal of the (in the scheme of things, small) "overdraft" direct purchase authority meant the Treasury was keeping extra ready cash--and due to the interest on reserves (the Treasury gets paid interest by the Fed?!?!!), Selgin claims, that extra cash went out of the economy and into to the traditional anti-bank account of the Federal Reserve System, the TGA. Now that the TGA acts as an anti-account, withdrawing, not adding money supply to the economy, it forces the interest rate obsessed Fed to do Open Market Ops, hoovering up Treasury Bonds (Selgin calls Treasury Bonds held by the Fed, "the Fed’s balance sheet.")in exchange for the plentiful reserves it was adding to the banking system.

(Now, the Treasury doesn't use it's Federal Reserve System so-called "account" the way the other account holders do. The other account holders loan their money out on the interbank lending market. The Treasury abstains from this, when "banking" with the Fed--so any money that goes into the Treasury General Account is money the banks no longer have access to until it is spent fiscally. So not just the Fed, but the Treasury, when so-called "banking" with the Fed acts as an "anti-bank.")

]

What's in the Coin--Does it Matter?

My, new, thought for today is that there's no difference between the paper modern dollars are printed on and the gold the old ten dollar and twenty dollar coins were minted with. Whether one is printing or minting, one at base just needs some material to make it with. Making a coin with gold helps prevent counterfeiting, one assumes; that can be a discussion in itself--how does one know a gold coin is not lead inside, with the requisite ten percent copper to make it weigh the same as a coin, as gold is so soft it can be guilded as thin as one likes. This thinness capacity can also serve as a basis of the Goldbacks alternative currency discussed some time ago on Sovren.

Yet my thought today is that the base value of gold comes from its traditional use as currency and not its value as currency from the characteristics of gold, as congenial as they are to use as physical material for coinage and even for general commodity money-like exchange and use.

Gold is just one physical material among many--there is no alchemy to gold other than what cold fusion provides as to production thereof (note the, quiet, experiments by Mitsubishi Heavy Industries around the transmutation of elements). If any other material (silver, copper, oil) were chosen as currency, its value would, as with gold's begin to ride on its use as-currency rather than as at first its value as itself alone. Such value as currency comes from value-in-use and not, primarily, from factors inherent to die-ding-an-zicht, gold's resistance to rust, its shinynesd, its potential for thinness (useful in goldbacks), or its resistance to mining. Take mining as ensample: putting aside that the vast hoarding of gold by the United States Department of the Treasury, and by other governments is likely a major reason for the current ever-increasing price of gold, putting aside also that gold no longer has its price pegged to a real currency (hence perhaps the extremely unstable price of gold bullion); take just the example of rarity: The United States dollar coin itself was silver, not, Spanish, gold.

Yield Curve Control

Or, the Same End Result

would be to just

Stop the Treasury from issuing Treasury Bonds to start with

To help explain the punchline, which comes at the end, my explanation as to that term, "reserves:" "reserves" as in "Federal Reserve-issued dollars."

Although, it might be argued that rather than as to first-origins being the Fed, government issued dollars start out as payments to Federal Contractors, though, then, directly into their banks, where they are termed, "reserves." You will quickly note something I left out, reserves as "account balances" at the Federal Reserve "Banks," which seems to me to be irrelevant to their function--a topic for another post--as they are fully controlled--correct me where I am wrong, aside from regulatory requirements, by the banks that hold them and not by the "Fed." The mainstream idea, though, is that the Treasury and Departments are not the sovereign issuer of the dollar: the Fed. is, and so only payouts from the Fed. are real hard dollars so that's why hard dollar accounts (as opposed to "bank money" credit-created dollars that always are created only to be repaid) are called "reserves."

On a recent podcast interview with Patricia Pino and Christian Reilly, 47 minutes, 10 Seconds into it, Mosler answers a question give by Christian Reilly, who asks, "something something yield curve control," I guess.

Mosler answers:

"What's the point of *yield curve control?* I don't know. How about just stop issuing those long term securities?

"So I asked Chairman Bernanke that question when I had a meeting with him--there was only four of us with him at he meeting when he was Chief Economic Advisor at the White House... And one of the questions I asked--we were just there to kind of ask innocent questions...

Mosler, to Bernanke:

Look. Given the fact that the Fed is talking about buying Treasury Securities *as part of your unconventional monetary policy.* Given the fact that the Treasury is selling securities in the market and then the Fed, buying them is functionally equivalent to the Treasury not selling them to begin with. Given that, has there been any discussion of the Fed coordinating with the Treasury so the Treasury doesn't have to sell them and the Fed buy them, just have the Treasury not issue them?'

Bernanke:

Well, no, there is a difference. When we buy them at the Fed it adds reserves.

Mosler:

So, clearly when Treasury sells them, it subtracts reserves...

My summary:

So you see:

-->If the the Fed is buying Treasury Bonds to add reserves, so logically, the Treasury initially auctioning those same Treasury Bonds before that subtracts reserves. Like this:

Step 1. Subtracting reserves, by adding Treasuries (Treasury, initial auction)

Step 2. Adding reserves, by buying Treasuries (The Fed, reverse auction)

Step 1 plus Step 2:

Subtraction of n reserves plus addition of n reserves = nothing happened. AND SO, if nothing happens, why do Step 1 in the first place?

So Mosler's idea is that if as a result of Step one (Treasury Issuance--under Congressional law, to the private sector only, via auction) and Step 2 (Fed reverse auction from the private sector "open market"), the result is NOTHING HAPPENS:

Then, why do Step one in the first place? If step one didn't happen, that is functionally the same as not doing step two, which functionally simply reverses step one.

The Pileus Hosts: The MMT Podcast, Episode 173 Warren Mosler: The Financial Sector - A Cost-Benefit Analysis