Become an Agent and Earn Rewards with the Referral Program - https://dapp.expert/dapp/en-trx-dragon7

Join our Referral Program today and unlock exciting rewards as you become an Agent for our brand! As an Agent, youll not only reap the benefits of our exceptional products and services but also earn enticing rewards for every successful referral you make.

Becoming an Agent is simple: just sign up for our Referral Program and start sharing your unique referral link with friends, family, and colleagues. Whether youre passionate about our products, impressed by our customer service, or simply excited to share something great, being an Agent allows you to spread the word and earn rewards while doing so.

With each successful referral, youll earn points that can be redeemed for exclusive discounts, free products, or even cash rewards. Plus, the more referrals you make, the greater your rewards become! Its a win-win situation your network gets to experience the benefits of our brand, and you get rewarded for it.

So why wait? Join our Referral Program today, become an Agent, and start earning rewards while spreading the word about something you love!

People

Circles

Posts

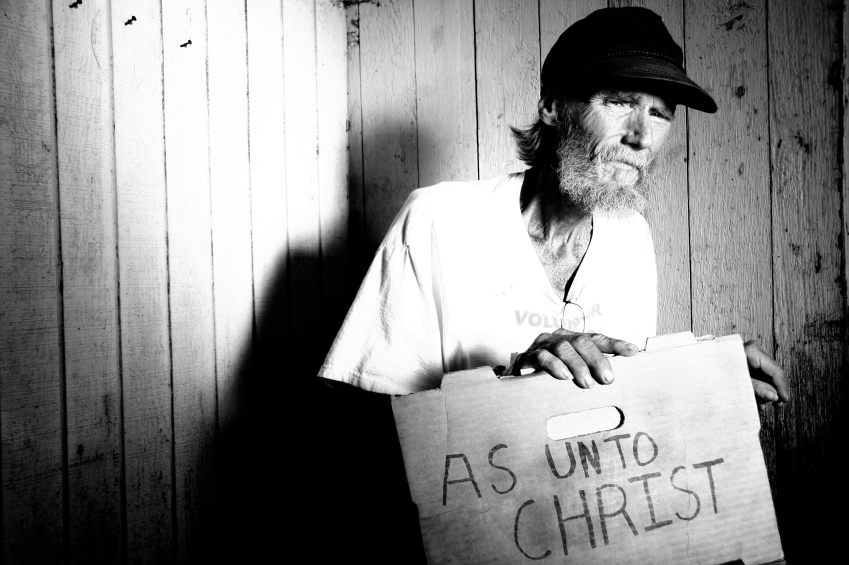

Feeling the Hurts of Others

By Billy Graham • February 12

He that loveth his brother abideth in the light . . .

—1 John 2:10

This age in which we live could hardly be described as conducive to a sensitiveness of the needs of others. We have developed a veneer of sophistication and hardness. Someone once said, “I am sorry for the man who can’t feel the whip when it is laid on the other man’s back.” Much of the world is calloused and indifferent toward mankind’s poverty and distress. This is due largely to the fact that for many people there has never been a rebirth. The love of God has never been shed abroad in their hearts. Many people speak of the social gospel as though it were separate and apart from the redemptive Gospel. The truth is: there is only one Gospel. We must be redeemed, we must be made right with God before we can become sensitive to the needs of others. Divine love, like a reflected sunbeam, shines down before it radiates out. Unless our hearts are conditioned by the Holy Spirit to receive and reflect the warmth of God’s compassion, we cannot love our fellowmen as we ought.

Prayer for the day

Help me to feel another person's hurt and be concerned, Father, so that I may shed the light of Your love in an uncaring world. Amen.

Operation Arrival

December 25, 2023

by Pastor Chuck Swindoll

Scriptures: Luke 1:68-75

“Praise the Lord, the God of Israel, because he has visited and redeemed his people.

He has sent us a mighty Savior[a] from the royal line of his servant David,

just as he promised through his holy prophets long ago.

Now we will be saved from our enemies and from all who hate us.

He has been merciful to our ancestors by remembering his sacred covenant—

the covenant he swore with an oath to our ancestor Abraham.

We have been rescued from our enemies so we can serve God without fear,

in holiness and righteousness for as long as we live. (Luke 1:68–75)

For the longest time I didn't understand the new-car industry. I had always thought it worked like this. When a guy wanted a car, he dropped by the local dealership, kicked a few tires, slammed some doors, and fiddled around with radios, hoods, and trunk lids. Then he would rap with the salesman, dicker over prices, choose his favorite color, and place the order. I figured that when headquarters got the specs, they'd scurry around the shop finding the right steering wheel, engine, chrome strips, and hubcaps, then make sure all that stuff got stuck on correctly before it was shipped. You know, kind of like whipping up a last-minute meal with grub from the kitchen.

But that's not the way it is at all. To my amazement, I discovered that a computer card puts into motion dozens of contacts all over the country. One spot makes only engines. Another, the glass and plastic parts. Some other outfit does the steering wheels, and yet another the carpet and vinyl. As the order is placed, it triggers action in all these related areas. And—hopefully—at just the right time the special things arrive at the assembly plant where it all comes together—everything from bumper bolts to windshield wipers. And within a relatively short period of time, a shiny new car is punched out, rolled onto a transport truck, and sent to its proper destination.

What a remarkable arrangement ingenious Americans have devised! And none of it was even thought of two hundred years ago.

Now then—if man can come up with an organizational plan as complex as all that, think of how much more efficient God's arrangement was . . . over two thousand years ago. I'm referring to the perfectly synchronized events surrounding the Savior's birth. For sure, it was no afterthought. Scripture assures us that

when the fullness of the time came, God sent forth His Son. (Galatians 4:4)

Fantastic statement! At just the right moment, precisely as God arranged it, in keeping with a plan we might dub "Operation Arrival," enter Messiah.

Micah said it would be in Bethlehem, Judah. It was. But I thought Joseph and Mary were of Nazareth, Galilee. They were. Aren't those places miles apart? Yes, in those times days apart. Then . . . how? Well, you see, that's just a small part of the plan, nevertheless amazing. Especially when you consider Mary was almost "term" in her pregnancy. To get them down south in time required fairly good roads—unheard of prior to the Roman takeover. And they certainly needed to be forced to travel . . . hence a required census from Caesar Augustus (Luke 2:1) that forced Joseph to register in person in the city of his family roots, Bethlehem (2:4).

But before a Savior could be born, there also needed to be some natural means of common communication—a familiar tongue that would quickly spread the news. No problem. Thanks to Alexander the Great, the father of koine Greek, that language was ripe and ready for rapid dissemination of the gospel message through the pen of the evangelists and apostles from then on.

Thanks to good roads, a decision in Rome, and a bothersome census, it happened at just the right place. At just the right time . . . with an articulate language as the perfect verbal vehicle. A little baby that the world hardly noticed arrived. Rome was too busy building and conquering. Augustus thought he was hot stuff prancing about the palace demanding that census. In reality he was little more than a wisp of lint on the prophetic page . . . a pawn in the hand of the Commander of "Operation Arrival."

The things God pulled off to get His Son delivered on time twenty-one centuries ago would make the pride of American ingenuity look like an organizational afterthought by comparison.

Videos

People

Circles

Videos

Posts

Become an Agent and Earn Rewards with the Referral Program - https://dapp.expert/dapp/en-trx-dragon7

Join our Referral Program today and unlock exciting rewards as you become an Agent for our brand! As an Agent, youll not only reap the benefits of our exceptional products and services but also earn enticing rewards for every successful referral you make.

Becoming an Agent is simple: just sign up for our Referral Program and start sharing your unique referral link with friends, family, and colleagues. Whether youre passionate about our products, impressed by our customer service, or simply excited to share something great, being an Agent allows you to spread the word and earn rewards while doing so.

With each successful referral, youll earn points that can be redeemed for exclusive discounts, free products, or even cash rewards. Plus, the more referrals you make, the greater your rewards become! Its a win-win situation your network gets to experience the benefits of our brand, and you get rewarded for it.

So why wait? Join our Referral Program today, become an Agent, and start earning rewards while spreading the word about something you love!

Feeling the Hurts of Others

By Billy Graham • February 12

He that loveth his brother abideth in the light . . .

—1 John 2:10

This age in which we live could hardly be described as conducive to a sensitiveness of the needs of others. We have developed a veneer of sophistication and hardness. Someone once said, “I am sorry for the man who can’t feel the whip when it is laid on the other man’s back.” Much of the world is calloused and indifferent toward mankind’s poverty and distress. This is due largely to the fact that for many people there has never been a rebirth. The love of God has never been shed abroad in their hearts. Many people speak of the social gospel as though it were separate and apart from the redemptive Gospel. The truth is: there is only one Gospel. We must be redeemed, we must be made right with God before we can become sensitive to the needs of others. Divine love, like a reflected sunbeam, shines down before it radiates out. Unless our hearts are conditioned by the Holy Spirit to receive and reflect the warmth of God’s compassion, we cannot love our fellowmen as we ought.

Prayer for the day

Help me to feel another person's hurt and be concerned, Father, so that I may shed the light of Your love in an uncaring world. Amen.

Operation Arrival

December 25, 2023

by Pastor Chuck Swindoll

Scriptures: Luke 1:68-75

“Praise the Lord, the God of Israel, because he has visited and redeemed his people.

He has sent us a mighty Savior[a] from the royal line of his servant David,

just as he promised through his holy prophets long ago.

Now we will be saved from our enemies and from all who hate us.

He has been merciful to our ancestors by remembering his sacred covenant—

the covenant he swore with an oath to our ancestor Abraham.

We have been rescued from our enemies so we can serve God without fear,

in holiness and righteousness for as long as we live. (Luke 1:68–75)

For the longest time I didn't understand the new-car industry. I had always thought it worked like this. When a guy wanted a car, he dropped by the local dealership, kicked a few tires, slammed some doors, and fiddled around with radios, hoods, and trunk lids. Then he would rap with the salesman, dicker over prices, choose his favorite color, and place the order. I figured that when headquarters got the specs, they'd scurry around the shop finding the right steering wheel, engine, chrome strips, and hubcaps, then make sure all that stuff got stuck on correctly before it was shipped. You know, kind of like whipping up a last-minute meal with grub from the kitchen.

But that's not the way it is at all. To my amazement, I discovered that a computer card puts into motion dozens of contacts all over the country. One spot makes only engines. Another, the glass and plastic parts. Some other outfit does the steering wheels, and yet another the carpet and vinyl. As the order is placed, it triggers action in all these related areas. And—hopefully—at just the right time the special things arrive at the assembly plant where it all comes together—everything from bumper bolts to windshield wipers. And within a relatively short period of time, a shiny new car is punched out, rolled onto a transport truck, and sent to its proper destination.

What a remarkable arrangement ingenious Americans have devised! And none of it was even thought of two hundred years ago.

Now then—if man can come up with an organizational plan as complex as all that, think of how much more efficient God's arrangement was . . . over two thousand years ago. I'm referring to the perfectly synchronized events surrounding the Savior's birth. For sure, it was no afterthought. Scripture assures us that

when the fullness of the time came, God sent forth His Son. (Galatians 4:4)

Fantastic statement! At just the right moment, precisely as God arranged it, in keeping with a plan we might dub "Operation Arrival," enter Messiah.

Micah said it would be in Bethlehem, Judah. It was. But I thought Joseph and Mary were of Nazareth, Galilee. They were. Aren't those places miles apart? Yes, in those times days apart. Then . . . how? Well, you see, that's just a small part of the plan, nevertheless amazing. Especially when you consider Mary was almost "term" in her pregnancy. To get them down south in time required fairly good roads—unheard of prior to the Roman takeover. And they certainly needed to be forced to travel . . . hence a required census from Caesar Augustus (Luke 2:1) that forced Joseph to register in person in the city of his family roots, Bethlehem (2:4).

But before a Savior could be born, there also needed to be some natural means of common communication—a familiar tongue that would quickly spread the news. No problem. Thanks to Alexander the Great, the father of koine Greek, that language was ripe and ready for rapid dissemination of the gospel message through the pen of the evangelists and apostles from then on.

Thanks to good roads, a decision in Rome, and a bothersome census, it happened at just the right place. At just the right time . . . with an articulate language as the perfect verbal vehicle. A little baby that the world hardly noticed arrived. Rome was too busy building and conquering. Augustus thought he was hot stuff prancing about the palace demanding that census. In reality he was little more than a wisp of lint on the prophetic page . . . a pawn in the hand of the Commander of "Operation Arrival."

The things God pulled off to get His Son delivered on time twenty-one centuries ago would make the pride of American ingenuity look like an organizational afterthought by comparison.

December 21

The Light of Hope

Bible in a Year :

Micah 4–5

Revelation 12

Put your hope in God, for I will yet praise him, my Savior and my God.

Today's Scripture & Insight :

Psalm 42

My mother’s shiny red cross should have been hanging next to her bed at the cancer care center. And I should have been preparing for holiday visits between her scheduled treatments. All I wanted for Christmas was another day with my mom. Instead, I was home . . . hanging her cross on a fake tree.

When my son Xavier plugged in the lights, I whispered, “Thank You.” He said, “You’re welcome.” My son didn’t know I was thanking God for using the flickering bulbs to turn my eyes toward the ever-enduring Light of Hope—Jesus.

The writer of Psalm 42 expressed his raw emotions to God (vv. 1–4). He acknowledged his “downcast” and “disturbed” soul before encouraging readers: “Put your hope in God, for I will yet praise him, my Savior and my God” (v. 5). Though he was overcome with waves of sorrow and suffering, the psalmist’s hope shone through the remembrance of God’s past faithfulness (vv. 6–10). He ended by questioning his doubts and affirming the resilience of his refined faith: “Why, my soul, are you downcast? Why so disturbed within me? Put your hope in God, for I will yet praise him, my Savior and my God” (v. 11).

For many of us, the Christmas season stirs up both joy and sorrow. Thankfully, even these mixed emotions can be reconciled and redeemed through the promises of the true Light of Hope—Jesus.

By: Xochitl Dixon

Reflect & Pray

How has Jesus helped you process grief while celebrating Christmas? How can you support someone who’s grieving this season?

Dear Jesus, thank You for carrying me through times of grief and joy all year round. Amen.

I Am Not Working from a “To Do” List - Journaling Prayer by LaWanda

LaWanda – ♪♪ “Who is like you Lord in all the earth? Matchless beauty, endless worth. Nothing in this world will satisfy. Jesus you’re the cup that won’t run dry. O Jesus, O Jesus, your presence is heaven to me. O Jesus, O Jesus, your presence is heaven to me.” ♪♪ Thank you, Jesus, that you ARE the cup that won’t run dry.

How do I see you today, Lord? I see you walking, Lord, with a small group around you. You are walking at a moderate pace, not too slowly but not racing forward either. One person asks a question and then another. We all have something we want to know it seems, and of course, you are the One who can answer them all. You take each one and slowly engage the person asking as though to see the heart beneath the question. And when you answer, we all sigh and say, “Yes, of course” because we had that question, too, but did not ask it. And now we know the answer.

O Jesus, you know us so well. Thank you for your tender mercies, which are new every morning. O how I need them, Lord, and how grateful I am for them, precious Jesus. Thank you, Jesus, for loving me so. Thank you, Lord, that I was one of the “joys” set before you as you faced the Cross. Thank you for the Cross, Lord.

Jesus – LaWanda, dear one, my precious, precious one. My mercies ARE new every day and they are new every day for YOU! Can you imagine how desolate your heart would be if you came to me and I told you I was all out of mercy today? This will NEVER happen, for at the Cross, everything that needed to happen, happened. I meant it when I said, “It is Finished!” I am not working from a “to do list” of things I need to do. What I did on the Cross took care of everything. EVERYTHING. There is nothing you need that was not provided for through My work on the Cross, LaWanda. Once you accepted Me, EVERY need was satisfied. It is your job to call it down from heaven to earth. My Kingdom come My Will be done on earth as it ALREADY is in heaven. O LaWanda, step into My Glory as you surrender everything to Me. As I have said so many times before: Surrender is not the end. It is the beginning and where you always must start.

Precious one, just keep coming to the secret place and sit near Me. If you do, I will surely do My part and pour out the revelation-secrets of My promises to you. It is one thing to have My promises, which every believer does. It is another thing altogether to have the secrets of those promises revealed to you personally by the One who spoke them in the beginning. This is My will for you, dear one, for I cannot resist a surrendered heart laid down before Me.

Hear Me now, dear one…

“There’s a private place reserved for the lovers of God, who sit near Me and receive the revelation-secrets of My promises.” Psalm 25:14

"Fear not, for I have redeemed you; I have called you by name, you are mine.” Isaiah 43:1

"I declare the end from the beginning and from ancient times things not yet done, saying, 'My counsel shall stand, and I will accomplish all my purpose.” Isaiah 46;10

Yes, My dear one, I will accomplish my purpose in YOU and My counsel SHALL stand, INDEED!

________________________________________

Fan the flames of revival by sharing this blog with your friends on social media!

________________________________________