Orthodox Jew Andrew Meyer says Israeli PM Netanyahu, the IDF and the Mossad allowed Oct. 7 attack to happen

https://www.naturalnews.com/2024-04-18-netanyahu-idf-mossad-allowed-oct-7-attack.html

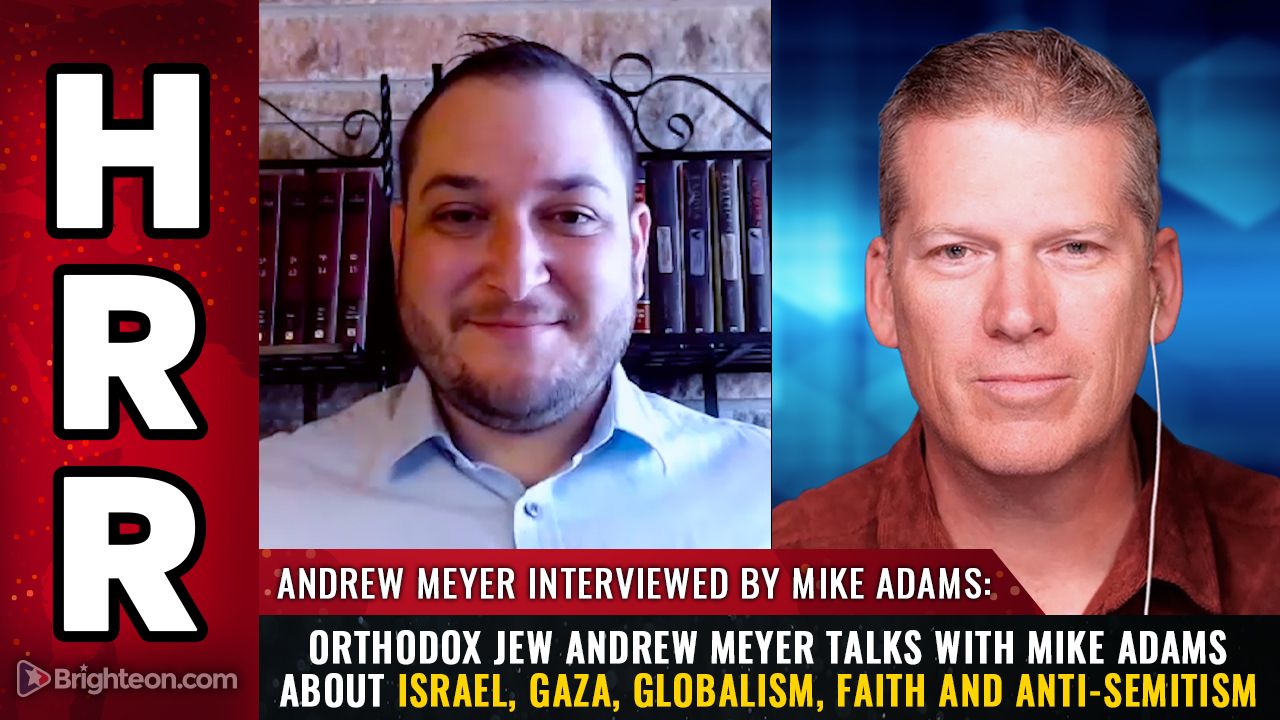

Israeli Prime Minister Benjamin Netanyahu, the Israel Defense Forces and the Institute for Intelligence and Special Operations – commonly known as Mossad – allowed the Oct. 7 attack to happen. This was the assertion of Andrew Meyer, an Orthodox Jew, during an interview with the Health Ranger Mike Adams. He remarked: “In Israel, there are […]

www.naturalnews.com