Daniel Lawler and Juliette Collen - What are attoseconds? Nobel-winning physics explained:

https://phys.org/news/2023-10-attoseconds-nobel-winning-physics.html

#Attosecond #Time #LASER #Electrons #NobelPrize #Physics

People

Circles

Posts

The Red Sprite and the Tree

Credit & Copyright: Maxime Villaeys

Explanation: The sprite and tree could hardly be more different. To start, the red sprite is an unusual form of lightning, while the tree is a common plant. The sprite is far away -- high in Earth's atmosphere, while the tree is nearby -- only about a football field away. The sprite is fast -- electrons streaming up and down at near light's speed, while the tree is slow -- wood anchored to the ground. The sprite is bright -- lighting up the sky, while the tree is dim -- shining mostly by reflected light. The sprite was fleeting -- lasting only a small fraction of a second, while the tree is durable -- living now for many years. Both, however, when captured together, appear oddly similar in this featured composite image captured early this month in France as a thunderstorm passed over mountains of the Atlantic Pyrenees.

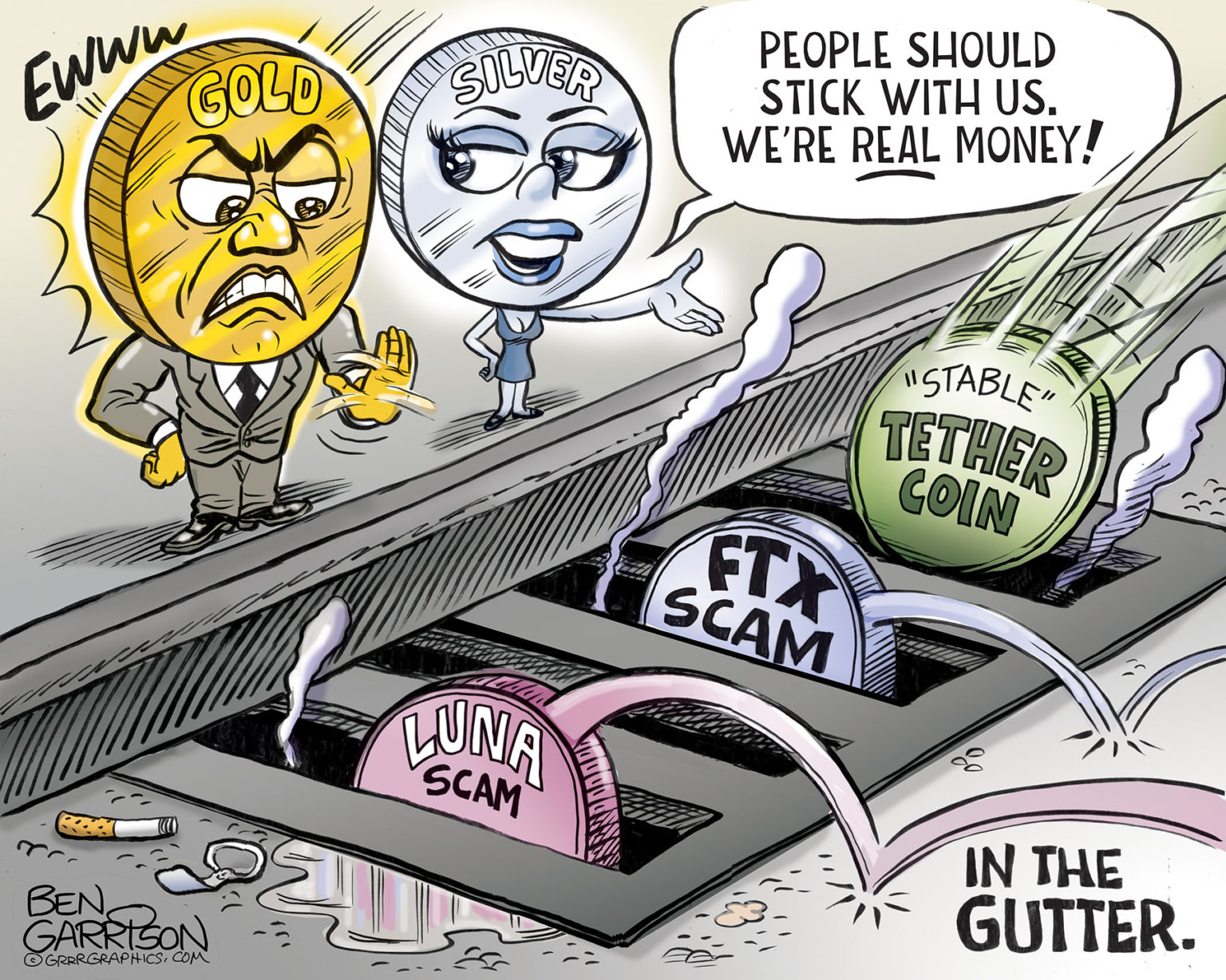

CRYPTO CRASH- GONE IN 60 SECONDS

Bitcoin was set up as a way to escape the debt dollar.

People could trade their dollars for an alternative currency and enjoy independence, privacy, and security.

My older brother alerted me to this new system of money over 10 years ago. I decided not to get involved with it. To me, it smelled like a giant scam. Of course, I missed out on windfall profits, but my initial misgivings haven’t changed.

All money originated from commodities such as gold, silver, and copper. Gold and silver are named in Constitution as America’s money. Gold was used as money throughout history because it’s rare. It’s hard to find in nature. (I know, I’ve tried gold panning for years). When people deposited gold in banks, receipts were issued. Then, instead of trading receipts back in for the gold when needed, the receipts themselves were traded. That was the origin of paper money. Banks quickly figured out that people rarely withdrew their gold. Therefore, more receipts could be issued than could be cashed in. When people discovered the fraud, the bankers were soon rendered insolvent due to runs on their banks. The point is, scam artists always look for ways to game any system.

Thanks to big government scam artists colluding with central banker scam artists, the Federal Reserve was created. Paper receipts became paper money, but awhile they could still be cashed in for gold and silver. Then that pretense was dropped and our paper money became what’s known as ‘fiat.’ This enabled the banks to issue endless paper money, which should lead to hyperinflation and worthless money, but there’s one difference. Our paper money is ‘debt’ money. That means it must be paid back to the bankers with interest, hence our ridiculous national debt. It’s an immoral system of money that enriches those at the top who issue the cash and it impoverishes everyone else.

It’s no wonder people clamored for a different system of money. Unfortunately, Bitcoin is not it. It might be rare due to its fixed circulation, but it’s not fungible. One can’t instantly pay for a variety of goods with Bitcoin. It’s still tied to the debt dollar and it must be ‘cashed out’ first. In fact, all cryptos remain tied to the dollar. When you hear, ‘What’s XYZ coin worth today,” you know they mean what it’s worth in debt dollars. Of course, gold and silver face this same problem. It’s difficult to pay for anything with gold and silver coins without ‘cashing them in’ first. Still, gold and silver are precious metals that people can hold in their hands or store in their sock drawer. You can’t store crypto in a safe; it must exist on an ‘exchange,’ or be kept in a digital ‘wallet.’ In other words, they exist as ideas and electrons stored who-knows-where and hacked by who-knows-who. If the electricity goes off, you won’t have access to your so-called crypto ‘money,’ but your gold and silver will always be there.

With the wild price swings and the ‘privacy’ and opacity that cryptocurrency can provide, it’s no wonder that it has attracted a legion of scam artists. After all, crypto is not really money at all. It’s an ‘investment,’ which implies losses can occur—even 100 percent losses. (We can replace the word ‘investment’ with ‘gambling’ and we might be closer to the truth). We’ve already seen the crash of Luna, a coin supposedly tied to the US dollar, but it was really based on lies, and when those lies were revealed, the coin crashed into oblivion. Now with FTX, it has been revealed to be based on lies that were supported and promoted by Democrats, celebrities, and even journalists who should have been investigating it. Forbes had the CEO, Sam Bankman Fried, on their cover even though he was nothing but a money-laundering Ponzi-scheme artist. Now it has crashed, leaving investors holding the bag.

The world’s largest Bitcoin fund, Grayscale, said it won’t be sharing proof of reserves with customers due to ’security concerns.’ What is odd is that Grayscale is trading at a 45 percent discount to the crypto coin. This is a bad sign that should shake confidence still further in the cryptocurrency world.

All the red flags, warning signs, and blaring sirens are going off. The collapse of Tether could be the nail in the coffin for cryptocurrency, but most likely it will provide an opening for the biggest corrupt scammer of them all to step in with a solution: The Fed central bankers will introduce their own ’safe’ and ‘regulated’ digital currency. A digital debt dollar. Inevitably, it will be tied to a social credit system, which means we will have no privacy when it comes to our purchases. It will be an even more tyrannical form of money than their paper debt dollar and if they force it upon us we must run away from it—and fast. The only safe place to run will be to gold and silver.

Those precious metals should not be seen as a gamble or a form of investment. Instead, they are a store of value and that’s an intrinsic part of what money should be.

— Ben Garrison

Videos

On this episode of The Cost of Everything we take a closer look at the cost of running an election. Does the politician win fair and square or does money influence in some way their success? Host Christy Ai sits down with Professor Ciara Torres-Spelliscy to discuss how much it costs for countries to host elections and what all the money is spent on.

People

Circles

Videos

On this episode of The Cost of Everything we take a closer look at the cost of running an election. Does the politician win fair and square or does money influence in some way their success? Host Christy Ai sits down with Professor Ciara Torres-Spelliscy to discuss how much it costs for countries to host elections and what all the money is spent on.

Posts

Daniel Lawler and Juliette Collen - What are attoseconds? Nobel-winning physics explained:

https://phys.org/news/2023-10-attoseconds-nobel-winning-physics.html

#Attosecond #Time #LASER #Electrons #NobelPrize #Physics

The Red Sprite and the Tree

Credit & Copyright: Maxime Villaeys

Explanation: The sprite and tree could hardly be more different. To start, the red sprite is an unusual form of lightning, while the tree is a common plant. The sprite is far away -- high in Earth's atmosphere, while the tree is nearby -- only about a football field away. The sprite is fast -- electrons streaming up and down at near light's speed, while the tree is slow -- wood anchored to the ground. The sprite is bright -- lighting up the sky, while the tree is dim -- shining mostly by reflected light. The sprite was fleeting -- lasting only a small fraction of a second, while the tree is durable -- living now for many years. Both, however, when captured together, appear oddly similar in this featured composite image captured early this month in France as a thunderstorm passed over mountains of the Atlantic Pyrenees.

CRYPTO CRASH- GONE IN 60 SECONDS

Bitcoin was set up as a way to escape the debt dollar.

People could trade their dollars for an alternative currency and enjoy independence, privacy, and security.

My older brother alerted me to this new system of money over 10 years ago. I decided not to get involved with it. To me, it smelled like a giant scam. Of course, I missed out on windfall profits, but my initial misgivings haven’t changed.

All money originated from commodities such as gold, silver, and copper. Gold and silver are named in Constitution as America’s money. Gold was used as money throughout history because it’s rare. It’s hard to find in nature. (I know, I’ve tried gold panning for years). When people deposited gold in banks, receipts were issued. Then, instead of trading receipts back in for the gold when needed, the receipts themselves were traded. That was the origin of paper money. Banks quickly figured out that people rarely withdrew their gold. Therefore, more receipts could be issued than could be cashed in. When people discovered the fraud, the bankers were soon rendered insolvent due to runs on their banks. The point is, scam artists always look for ways to game any system.

Thanks to big government scam artists colluding with central banker scam artists, the Federal Reserve was created. Paper receipts became paper money, but awhile they could still be cashed in for gold and silver. Then that pretense was dropped and our paper money became what’s known as ‘fiat.’ This enabled the banks to issue endless paper money, which should lead to hyperinflation and worthless money, but there’s one difference. Our paper money is ‘debt’ money. That means it must be paid back to the bankers with interest, hence our ridiculous national debt. It’s an immoral system of money that enriches those at the top who issue the cash and it impoverishes everyone else.

It’s no wonder people clamored for a different system of money. Unfortunately, Bitcoin is not it. It might be rare due to its fixed circulation, but it’s not fungible. One can’t instantly pay for a variety of goods with Bitcoin. It’s still tied to the debt dollar and it must be ‘cashed out’ first. In fact, all cryptos remain tied to the dollar. When you hear, ‘What’s XYZ coin worth today,” you know they mean what it’s worth in debt dollars. Of course, gold and silver face this same problem. It’s difficult to pay for anything with gold and silver coins without ‘cashing them in’ first. Still, gold and silver are precious metals that people can hold in their hands or store in their sock drawer. You can’t store crypto in a safe; it must exist on an ‘exchange,’ or be kept in a digital ‘wallet.’ In other words, they exist as ideas and electrons stored who-knows-where and hacked by who-knows-who. If the electricity goes off, you won’t have access to your so-called crypto ‘money,’ but your gold and silver will always be there.

With the wild price swings and the ‘privacy’ and opacity that cryptocurrency can provide, it’s no wonder that it has attracted a legion of scam artists. After all, crypto is not really money at all. It’s an ‘investment,’ which implies losses can occur—even 100 percent losses. (We can replace the word ‘investment’ with ‘gambling’ and we might be closer to the truth). We’ve already seen the crash of Luna, a coin supposedly tied to the US dollar, but it was really based on lies, and when those lies were revealed, the coin crashed into oblivion. Now with FTX, it has been revealed to be based on lies that were supported and promoted by Democrats, celebrities, and even journalists who should have been investigating it. Forbes had the CEO, Sam Bankman Fried, on their cover even though he was nothing but a money-laundering Ponzi-scheme artist. Now it has crashed, leaving investors holding the bag.

The world’s largest Bitcoin fund, Grayscale, said it won’t be sharing proof of reserves with customers due to ’security concerns.’ What is odd is that Grayscale is trading at a 45 percent discount to the crypto coin. This is a bad sign that should shake confidence still further in the cryptocurrency world.

All the red flags, warning signs, and blaring sirens are going off. The collapse of Tether could be the nail in the coffin for cryptocurrency, but most likely it will provide an opening for the biggest corrupt scammer of them all to step in with a solution: The Fed central bankers will introduce their own ’safe’ and ‘regulated’ digital currency. A digital debt dollar. Inevitably, it will be tied to a social credit system, which means we will have no privacy when it comes to our purchases. It will be an even more tyrannical form of money than their paper debt dollar and if they force it upon us we must run away from it—and fast. The only safe place to run will be to gold and silver.

Those precious metals should not be seen as a gamble or a form of investment. Instead, they are a store of value and that’s an intrinsic part of what money should be.

— Ben Garrison

Papageorgiou, Ecole Polytechnique Federale de Lausanne - Stabilizing polarons opens up new physics:

https://phys.org/news/2022-10-stabilizing-polarons-physics.html

#EPFL #Polarons #Electrons #Phonons #DensityFunctionalTheory #DFT #Crystal #Physics

SpaceRef - The Source Of Super-fast Electron Rain Discovered:

http://spaceref.com/earth/the-source-of-super-fast-electron-rain-discovered.html

#ElectronRain #Electrons #ELFIN #THEMIS #SpaceWeather #SolarPhysics #Physics