Navigating Divorce: A Comprehensive Guide to Getting Divorced in New York

Discover the essential steps and legal requirements for divorcing in New York with our comprehensive guide. From initiating the process to navigating property division, child custody, and support arrangements, we provide clear insights and practical advice. Learn about residency requirements, filing procedures, and options for mediation or litigation. Whether you're considering divorce or in the midst of it, empower yourself with knowledge to make informed decisions and effectively navigate the legal complexities of divorce in New York.

web: https://srislaw.com/how-to-get-divorced-in-new-york/

DivorceNewYork

People

Circles

Posts

NAPOLEON , the story of the emperor of France's love life from beginning to its conclusion. He actually divorced Josephine because a woman having sex with multiple partners leads to sterilisation. He acquired a son by marrying a teenage girl. Life ended for him by his being poisoned with arsenic. Before you watch this film understand Napoleon's biography to explain his success. He was an outcast from French aristocracy. He was frowned upon by being Corsican and not French. His first job as an officer was as an artillery officer. The lowest position. But he thought outside the norm and excelled by that means.

10/10 "go sees" #Napoleon #filmreview #movie #film https://www.youtube.com/watch?v=OAZWXUkrjPc

Make your Love Finding Journey More Sparkling with Telugu Matrimony

Find timeless love with Telugu Matrimony. With our 35 plus matrimony services explore your love interest at any age. We're dedicated to uniting hearts with experience, forging bonds that stand the test of time. Join us to find your perfect match and embark on a journey filled with joy, companionship, and lasting happiness.

For more information - https://www.telugumatrimony.com/united-states-of-america-divorced-grooms

Call us at - 8144998877

#telugumatrimony #bharatmatrimony #matrimony #marriage #wedding #onlinematchmakingservices

Videos

People

Circles

Videos

Posts

Navigating Divorce: A Comprehensive Guide to Getting Divorced in New York

Discover the essential steps and legal requirements for divorcing in New York with our comprehensive guide. From initiating the process to navigating property division, child custody, and support arrangements, we provide clear insights and practical advice. Learn about residency requirements, filing procedures, and options for mediation or litigation. Whether you're considering divorce or in the midst of it, empower yourself with knowledge to make informed decisions and effectively navigate the legal complexities of divorce in New York.

web: https://srislaw.com/how-to-get-divorced-in-new-york/

DivorceNewYork

NAPOLEON , the story of the emperor of France's love life from beginning to its conclusion. He actually divorced Josephine because a woman having sex with multiple partners leads to sterilisation. He acquired a son by marrying a teenage girl. Life ended for him by his being poisoned with arsenic. Before you watch this film understand Napoleon's biography to explain his success. He was an outcast from French aristocracy. He was frowned upon by being Corsican and not French. His first job as an officer was as an artillery officer. The lowest position. But he thought outside the norm and excelled by that means.

10/10 "go sees" #Napoleon #filmreview #movie #film https://www.youtube.com/watch?v=OAZWXUkrjPc

Make your Love Finding Journey More Sparkling with Telugu Matrimony

Find timeless love with Telugu Matrimony. With our 35 plus matrimony services explore your love interest at any age. We're dedicated to uniting hearts with experience, forging bonds that stand the test of time. Join us to find your perfect match and embark on a journey filled with joy, companionship, and lasting happiness.

For more information - https://www.telugumatrimony.com/united-states-of-america-divorced-grooms

Call us at - 8144998877

#telugumatrimony #bharatmatrimony #matrimony #marriage #wedding #onlinematchmakingservices

I worked with a client some years back who's a Borderline. She had a litany of symptoms related to her personality disorder, not the least of which was emotional dissociation.

She routinely cheated on her husband, had food phobias, her teenaged son had recently identified as female, and she almost immediately after starting work with me, immersed herself in a 'business success' program that (ironically enough) honored no sense of professional boundaries. To me, it was new-age quackery.

Borderlines FEAR attachment~ even to a professional who's attempting to help them. She HAD to diffuse her work with me, because the terror of relying on any single source for help felt too daunting.

In my BPD male article, I call this multi-therapist issue intended to manage one's anxiety of feeling too close, The Buckshot Method. The client keeps a 'stable' of professionals on hand, in case of any unforeseen "emergency" that might arise.

I've had psychologists in my practice, who try to maintain several therapeutic relationships at once. The minute I find out a client is seeing someone else for help besides me, I sign off the deal. Too many cooks in the kitchen spoil the broth. At some point, the clinicians' paths will diverge, and what happens to the rider who's standing on the backs of more than one horse?

I gave her options: Either she go on hiatus with that program, or with me. I was willing to resume with her, once she'd finished her "course." She replied that she had no intention of finishing. This program would be ongoing, she said. My integrity wouldn't allow me to continue working with her, as it was obvious she'd already undermined her progress.

My sense was that she'd one day contact me again. She did, about 1.5 years later. She was now divorced, romantically involved with a woman, her business had failed and closed, and there was no mention whatsoever of her child in the email she'd sent me. Still incredibly self-absorbed, poor dear.

This gal apologized profusely for squandering her opportunity to recover, and implored me to work with her again. Can you guess my answer?

A solid therapeutic relationship must be one of MUTUAL trust. Once trust is undermined for client OR practitioner, a meaningful bond can rarely be reestablished. Sadly, her life has gone from bad to worse. I feel sad about this~ mostly because we'd shared a vibrant connection for a short time, and I felt quite confident her difficulties could all be resolved with my care.

The transgender movement has spread like a malignant, metastasized, inoperable tumor since the time I was in contact with this client. She'd asked me back then, if I would consider working with her child, and I had agreed.

My biggest regret in this situation, was not getting the chance to save one more kid from a lifetime of regret and emotional despair.

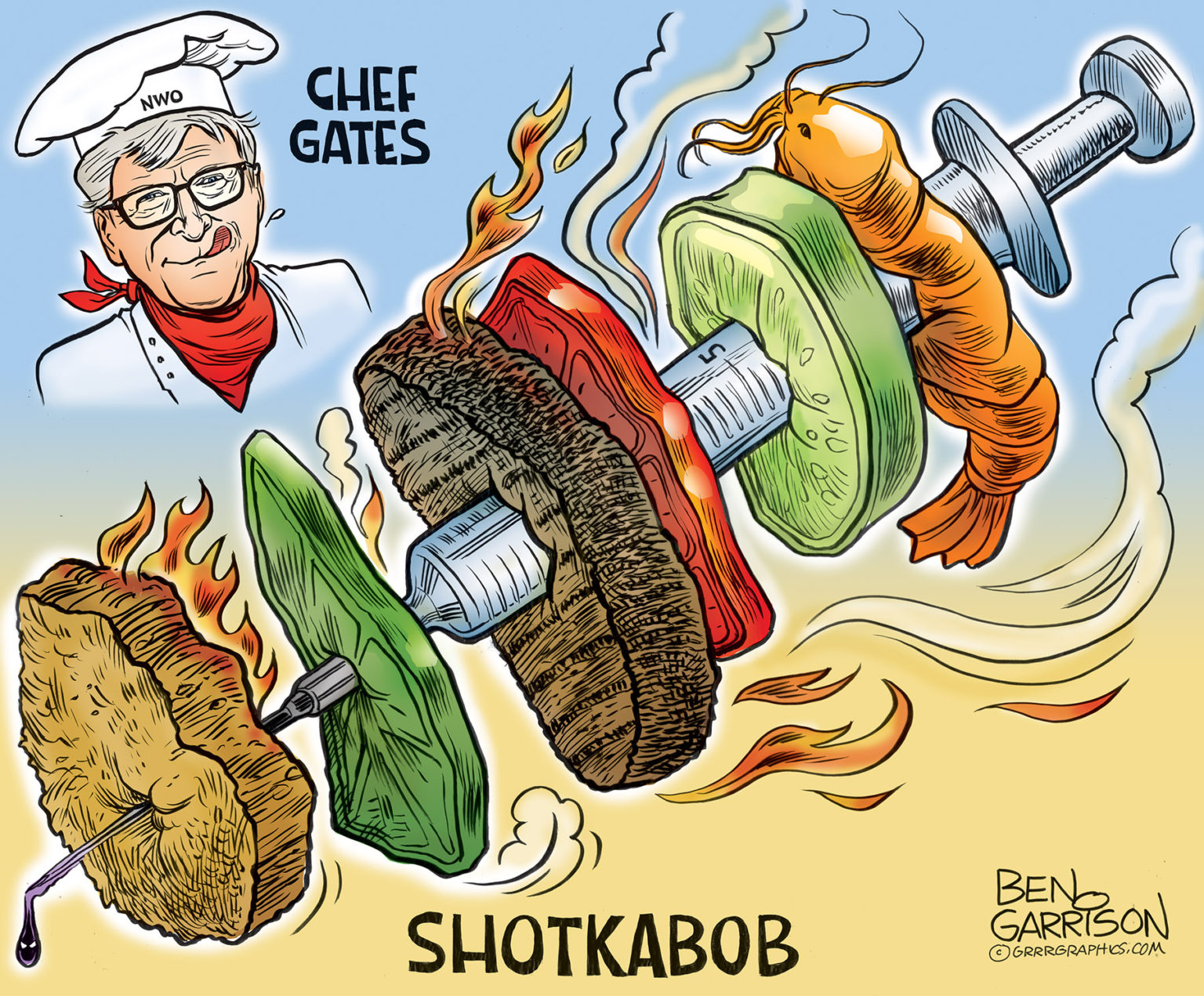

CHEF BILL GATES SERVES UP THE ‘SHOT-KABOB’

If you perform a Google search by typing in “Bill Gates Vaccines in Food,” Google will immediately tell you it’s all lie. A misunderstanding. Misinformation. Gates never had any intention whatsoever to forcibly vaccinate everyone by means of food.

The phrase ‘methinks thou dost protest too much’ came to mind.

Google, a subsidiary of the CIA, frames searches to suit the narratives they want to see disseminated. It’s the same thing with the faked moon landings. Google will bring up page after page and post after post telling you that the landings were real. After all, the CIA helped fake them and they must protect their lie.

The lies of Bill Gates are likewise protected. Remember when he claimed he once had a business meeting with Epstein and that was it? Turned out it was far more than that. Epstein was blackmailing him by exposing his affair with a Russian bridge player named Mila Antonova, a very young-looking woman who resembles Greta Thunberg. Why would such a young person be interested in having an affair with an old man who is also a complete dork? Oh, I almost forgot. Gates is a billionaire and such people feel like they have carte blanche to do whatever they like. Epstein certainly did. What will be revealed next—did Gates visit Epstein Island as well? Perhaps that’s why Melinda Gates divorced him.

Don’t be surprised if Gates is slipping in vaccines into our food by means of animal inoculation.

He will claim he’s doing it to benefit mankind, but it’s clear that Gates wants global depopulation. He sees vaccines as a miracle that can make that happen. He’s also into controlling the global food supply. He became heavily invested in Monsanto (now merged with Bayer) and their GMO foods. Gates keeps tinkering with our food. He likes artificial meat. He wants farms and cattle ranches shut down and replaced with his Franken-food!

Bear in mind that Gates is not a medical professional. He doesn’t have a medical degree or any sort of college degree at all. He’s not a virologist or scientist, but he has invested hundreds of millions of dollars and heavily influences Big Pharma and the vaccine industry at every turn. Gates is also the single largest owner of farmland in the world. What’s his plan for all of that land? Nothing good.

Never forget that Bill Gates wants you dead.

— Ben Garrison